With all the hoopla about Walz checks and other much-publicized aspects of the Minnesota Legislature’s plans to spend the state’s surplus, a reinstatement and extension of the state’s Historic Structure Rehabilitation Tax Credit probably never hit local TV news. But stories of using the “state’s historic tax credits” appeared in local newspapers across the state, letters of support were written, and finally, with Gov. Tim Walz’ signing of the omnibus tax bill, this tool was restored and protected for eight years.

According to RevitalizeMN, the advocacy group for this measure, for every tax dollar foregone, $11.30 is generated in private investment statewide. While new construction is intense in materials cost, historic renovations spend more in labor – i.e. this is job creation.

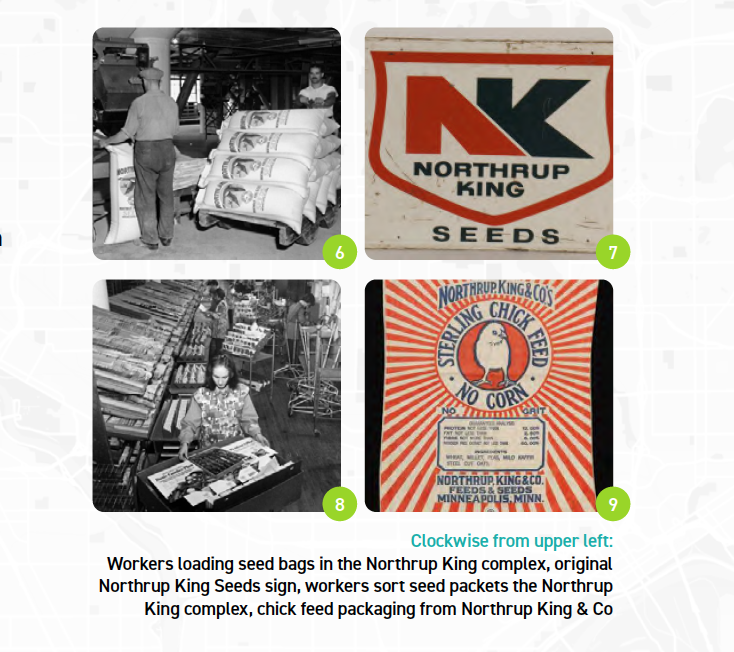

On recommendation of an artist who also works as a lobbyist, Arts District board members Jennifer Young, Josh Blanc and Margo Ashmore all wrote letters and made calls urging support. Why? State and federal tax credits, 20% each, combined 40%, are a major way of making the financial numbers work for projects that involve renovating old buildings for reuse as housing, public spaces, businesses and uniquely important to us, art spaces. Think Northrup King Building, the Little Sisters of the Poor (Stonehouse Square) building and perhaps in the future, other Northeast buildings.

Many conditions have to be met, including certification as a historic structure, meeting the “substantial rehabilitation test,” and blessing by the National Park Service.

State Senator Kari Dziedzic of Northeast carried the measure in the Senate. We thank her and the members of the Senate Tax Committee for their strong support, and the conferees – members of the House Tax Committee who listened and negotiated in good faith to this happy conclusion.

—by Margo Ashmore